On Day 2 of Programmatic IO,Chris Kane, the founder of Jounce Media, unveiled the intricacies of bidstream congestion, exploring auction duplication, inefficiencies in the ad tech supply chain, and the future of the ecosystem’s battle for attention.

Chris woke us up with a bang, delivering a highly insightful session at AdExchanger’s Programmatic IO. He shed light on bidstream congestion, a major issue complicating digital advertising today. Bidstream congestion occurs when the same ad impression opportunity is offered multiple times through different supply paths.

It leads to discrepancies, increased cost, and complexity in the bidding process. Chris addressed this by walking us through the intricacies. His emphasis on “deepening the dependencies” was vital to understanding the financial flows within the supply chain, urging the audience to think beyond surface-level transactions. From the open internet share shift to the nitty-gritty of auction duplication, Chris provided a deep dive into how advertisers, publishers, and intermediaries interact in such a crowded space.

The explosive growth of the industry catalyzed an arms race among publishers competing for attention in an overly saturated market, leading to challenges for advertisers and media agencies alike.

The Big Players and Their Influence

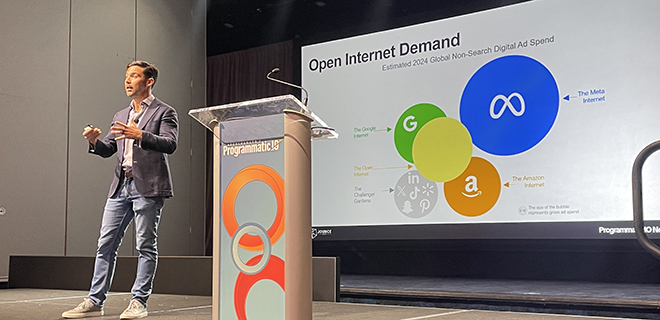

Chris started his session with a detailed analysis of open internet ad spend over the past eight years. Over this timeframe, we saw Google’s gross ad spend take off in 2021, with them dominating the market from 2020 to 2024. Google leads open internet gross ad spend projections for 2024, with The Trade Desk and Amazon DSP right behind them.

Walled gardens like Google, Meta, and Amazon operate closed systems that significantly influence market dynamics. Google’s non-search advertising is projected to hit $35 billion, Meta commands between $100 billion and $120 billion, and Amazon is at $45 billion. In contrast, the open internet still retains a significant share of the market, valued at $70 to $75 billion, providing an alternative to these walled gardens.

What’s also interesting is how these platforms reshape how the industry allocates spending.

According to Chris, LinkedIn, X (formerly Twitter), TikTok, Snapchat, and Pinterest are rising challenger gardens. But things are shifting. While these platforms may not match the spend of the giants, they are creating their own lane. This share shift could totally reshape the competition. In his overview, Chris highlighted just how huge the Walled Gardens’ influence is over market activity. This was the central theme of his discussion as he dove into detail about the various aspects of the ad tech supply chain.

While walled gardens offer a streamlined approach with integrated services, the open internet is more flexible. Navigating between these two requires a nuanced understanding of each platform’s strengths and limitations. Enterprises must strategically balance investments to optimize their advertising reach and efficiency.

The Anatomy of Bidstream Congestion: The Bloat

Bidstream congestion happens when multiple publishers send the same ad impression through different supply paths, resulting in redundant auction entries that DSPs need to sift through.

DSPs process approximately 30 million bid requests per second, a number that grows as publishers try to ensure their inventory gets noticed by the right buyers. Each publisher competes fiercely to make its inventory attractive to DSPs, who ultimately decide which auctions are worth pursuing.

Chris emphasized how ads.txt bloat has become symptomatic of this congestion. The average number of authorized supply paths for top RTB-traded websites, mobile apps, and CTV apps has skyrocketed from January 2020 to January 2024.

This means more paths for advertisers and more complications for DSPs drowned with duplicate and redundant opportunities. Despite publishers initiating numerous auctions, DSPs often listen to the same bid requests. This disparity reveals a harsh truth: initiating more auctions doesn’t necessarily improve a publisher’s chances of being selected.

Auction Duplication: A Path to Efficiency or Chaos?

One huge contributor to bidstream congestion is auction duplication. In this process, publishers engage multiple SSPs to re-auction the ad inventory, aiming to increase the likelihood of being selected by DSPs. While this strategy may seem rational for publishers seeking higher demand, the more SSPs involved, the harder it is to trace each dollar of ad spend.

“When it comes to rebroadcasting supply chains, four out of every ten bid requests are duplicative options that take multiple fees and expose problems in the supply chain. Today 40% of the midstream is multi-hop resale.” Chris said when illustrating rebroadcasting. In terms of direct paths and monetizing sites and apps the median across the full web, mobile app and CTV supply is 16.

“The average total impression is presented 16 times through direct supply chains, 41% of bidding requests are rebroadcasted and 59% are direct supply chains. With each impression made available 16 times through direct supply chains, plus another 14 times through rebroadcasted supply chains there is a 30x auction duplication.”

Yet, despite the congestion and duplication, this structure is seen as a necessary evil to maximize monetization potential, raising questions about whether the duplication ultimately serves or hinders the industry’s long-term growth. While it’s a way for publishers to ensure their inventory gets more eyeballs, this duplication creates inefficiencies that the entire industry must grapple with, inflating bid streams and increasing the overall cost of ad placements.

In simpler terms, rebroadcast paths mean that bid requests go through multiple hops before they reach a potential buyer. “DSPs who do not take advantage of rebroadcasting opportunities will go out of business,” Chris pointed out. The industry is evolving, and those who don’t evolve with it — whether they’re buyers, sellers, or intermediaries — could be left in the dust.

A Look to the Future: Will Duplication Save the Day?

Chris closed by exploring whether auction duplication is an efficient solution to bidstream congestion or a stopgap for masking deeper issues. On one hand, duplication is a great opportunity for publishers, providing them multiple chances to get their inventory seen, thus maximizing potential revenue. On the other hand, it adds layers of complexity that make the supply chain inefficient and opaque, driving up costs for everyone involved.

“Understanding the programmatic supply chain is no longer optional for stakeholders in the ad tech space. It requires the operational mindset of an insider — someone willing to get their hands dirty in the technical details of how inventory is auctioned, sold, and bought. You have to deepen the dependencies to really understand how money moves in the supply chain,” Chris said.

The ad tech ecosystem is changing rapidly, and bidstream congestion is but one symptom of the evolution. Whether auction duplication can effectively mitigate congestion or add more fuel to the fire is still a debate. But for those in the trenches of ad tech, understanding these dynamics is essential to navigating the future — and making sure they come out on top.

Industry leaders must innovate and adopt new practices to mitigate the detrimental effects of bidstream congestion. Auction duplication, while currently the norm, requires reevaluation.

Publishers and advertisers need to explore ways to streamline the bidding process, perhaps by improving the transparency and efficiency of SSP-DSP interactions or implementing more advanced targeting algorithms to reduce unnecessary bid requests.